This advice has been compiled in conjunction with the British High Commission in New Zealand to help you make informed choices.

What to avoid

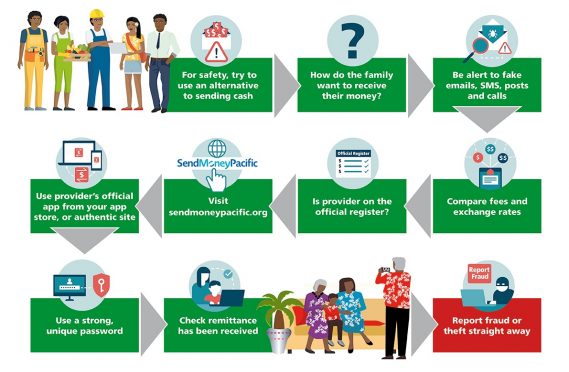

- Paying unnecessarily high fees for remittances. Please visit www.sendmoneypacific.org for information and advice, see below under ‘Safe remittances’.

- Potential poor availability/reliability of agents where your family lives, to deliver the money you have transferred.

- Fraud:

- Being tricked via email, text, DM (direct message), social media post or in person, by a fraudster posing as a money remitter.

- Inadvertently allowing a scammer to gain access to your bank account or online remittance service, in order to steal your funds by withdrawing money or making payments you have not authorised.

- Being deceived into participating in criminal activity (such as money laundering).

Safe remittances

- You should always use a registered or licensed remittance provider. Providers who are not registered are doing so illegally. In New Zealand, for example, you can check whether a provider is on the Financial Service Providers Register at https://fsp-register.companiesoffice.govt.nz Providers in New Zealand must also be members of an authorised Dispute Resolution Scheme (DRS) in case there is a problem with the remittance services provided. You can find information on this at https://fsp-register.companiesoffice.govt.nz/help-centre/dispute-resolution-schemes-drss/choosing-a-dispute-resolution-scheme.

- Remittance providers in any Pacific country should also be registered or licensed in the country or countries where they operate; any unregistered or unlicensed provider is doing so illegally and the funds may not be transferred safely.

- It is preferable to use registered remittance services than sending cash. If you must use cash, however, do not entrust it to individuals, groups or ‘couriers’ you do not know, who offer to take it back to family or friends in your country. Also, ensure you get a receipt and check the details carefully.

- There are a number of resources to help you choose a remittance provider. You may have heard of or used one of the well-known remittance companies such as Western Union or Moneygram, but there are other remittances providers operating in the Pacific, and one of these might suit your circumstances better. To help you, visit www.sendmoneypacific.org, a website set up through the joint New Zealand and Australian Government-led initiative ‘Reducing the Cost of Remittances to the Pacific’. This website compares the different remittance providers to show you which providers offer the most favourable exchange rate and fees, and the most appropriate type of service for your needs. The website also answers most of the questions you are likely to have about how remittances work, and helps you make an informed choice of provider or service. Don’t forget to ask family members or friends who you are remitting money to, what the easiest and safest way for them to receive the funds is. This may help you make your choice of provider. You could also ask your employer for advice, if you believe they are trustworthy.

- Learn to recognise the signs of a remittance fraud or other scam by criminals. You can find out about the most common ways fraudsters attempt to deceive you by visiting our Social Engineering advice page on this website. You can also find information on how to avoid financial scams at www.fma.govt.nz.

- You should also protect your remittance service, banking and any other financial services accounts by using a password unique to that service. (If you use the same password for more than one service and one is hacked, criminals can access all of your accounts which share the same password). Do not share your login details with anybody else either verbally, in an email, text, DM or social media post. A responsible remittance provider will never ask for your login details. Check out our advice on safe creation and use of passwords at our Passwords advice page on this website.

- When you arrange a remittance with a registered provider, you will be asked to provide certain information and documents to prove your name, date of birth and address. This is required so that the provider can comply with anti-money laundering regulations and help to make your remittances safer. This is sometimes referred to as the ‘Know Your Customer’ or ‘KYC’ process.

- Always check that your remittance has been received by contacting your family/friend directly, as well as checking confirmation notifications from the service. When arranging or discussing remittances with family/friends, use an encrypted messaging app such as WhatsApp and consider confirming via a phone call. Never quote account numbers or passwords in messaging apps, emails or DMs.

- If you are living in one of the Pacific Islands and receiving funds from a family member in Australia, New Zealand or elsewhere, you should check whether the agent you intend to collect the funds from is authorised in your country to provide this service. You should also ask your family member in New Zealand or Australia to ensure that the remittance provider they are using is registered or licensed there as a money remitter.

- If you become the victim of fraud or theft, report it immediately to the Police. If fraud or theft has occurred as a result of a payment from your bank account, report it to the bank immediately in case they can stop the movement of the money and pursue the perpetrator.

Other advice to help you make safe online remittances

- If you are planning to make remittances by means of a mobile app, ensure you use one downloaded only from your device’s app store: Apple’s App Store, Google Play or Microsoft Store. Apps from unofficial sources could result in fraud or identity theft. Be sure to check reviews from other users.

- When setting up accounts with remittance or other financial services providers, devise strong passwords that you do not use for other accounts (in case one suffers from a data breach). Keep your passwords strictly to yourself and do not be persuaded to use them except when logging into a service you know to be authentic. We recommend using a reputable online password manager to help you store and remember all your passwords, instead of writing them down. For information on creating and protecting your passwords, visit our Passwords advice page on this website.

- Use a service with two-factor authentication (where you need to enter a PIN received via text or email) before you can gain access to your account. It’s more secure that way.

- When prompted, always update operating systems, software and apps on computers and mobile devices. As well as improving your user experience, updates usually contain security fixes to help make your transactions safer. You can usually set up operating systems, software programs and apps to update automatically to make the task easier.

- Always have up-to-date internet security software or app (often known as ‘antivirus’) loaded and switched on. This applies to computers, smartphones and tablets – including Apple devices.

- Avoid clicking on links in emails, texts, posts or DMs (direct messages) – or opening email attachments – in case they lead to a fraudulent website or cause you to download malware. Both can result in fraud or identity theft, or both.

- If you are out and about, avoid using Wi-Fi hotspots in cafes, bars, hotels and other public places for remittances and any other payments or financial transactions. This is because the hotspot may not have been set to ‘secure’, and could even be a fake hotspot set up by a fraudster. You can find more information on Wi-Fi hotspots at our Wi-Fi advice page on this website.